Central Bankers and Governments worst fears have arrived in a second and more destructive wave of inflation.

For months we have been told that inflation is under control and it is moving back to the two to three percent target range and there is a strong possibility of rate cuts to provide relief for mortgage holders.

Earlier this week i wrote an article stating that inflation was not slowing and was in fact rising sharply after comparing costs over a six week period for many shopping items.

I again compared items yesterday from Coles and Woolworths from only seven days ago and many of the items had risen sharply again in just one week. Many of the items had risen between 10% to 20% in just one week. This is a clear signal that a second wave of inflation is here or you could look at it that the currency is losing more and more value.

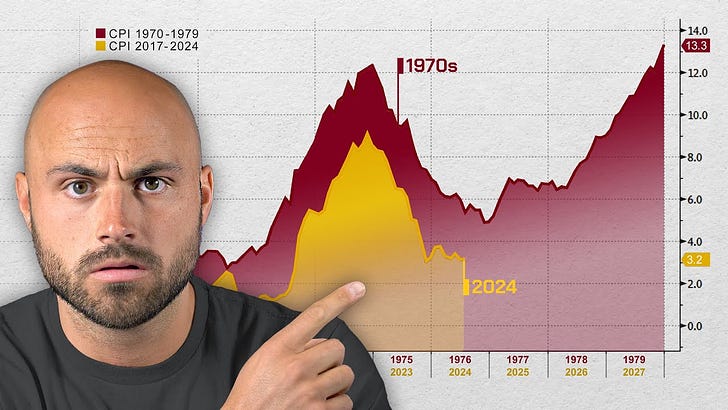

Most economists talk about the first big wave of inflation after Covid where inflation was roaring at around 8% according to official government figures before moving down to the 5% and then 3% percent range. We know those official government figures are lower than the real inflation rate, but the illusion will be impossible to hide now despite the endless propaganda from the media where price rises can no longer be hidden to the masses.

The checkout lady at Coles told me yesterday that many people had made comments over the fast rises in prices over the last fortnight and how hard it was it to live. The lower and middle classes are really feeling and noticing the higher costs and it is getting worse and worse each week.

The nominal interest rate today is 4.35% in Australia and this has been kept on hold since November 2023. This is still below USA 5.5%, Canada 5%, UK 5.25%, NZ 5.5%. The average European rate is 4.5%.

Higher inflationary countries such as Turkey and Argentina have rates at an incredible 50% and 70% respectively.

Jim Chalmers and the RBA have popped the cork too early in celebrations in the fight against inflation and the question is now what do they do with the second wave of inflation hitting our shores which is moving at rapid pace and has the potential to take the entire house down.

Will the RBA now raise rates in early May?? I believe if they don’t raise in May we are 100% certain to now see rate hikes in either June or July. One rate hike won’t be enough and we are likely to see many more as the debt bomb explodes and double digit rates is now a realistic possibility to fight off inflation and save currencies.

With no alternative then to raise rates, systemic system risk increases greatly with the debt at record levels and astronomical housing prices which then puts banks at greater risk as defaults rise across the country.

In the Reagan administration during the 1980’s, Paul Volker and Reagan immediately raised rates to 19% to combat severe inflation after Jimmy Carter had a second wave of inflation during his administration, but the problem today is the debt is so much more and the risks are exponentially higher to banks, governments, businesses and households.

The central banks and governments around the world have made a complete mess with years of low rates creating massive bubbles in stocks and real estate and endless government spending especially during the covid period where debts and deficits exploded leading to sustained and high inflation.

Central Banker and Governments are now working against each other with incompetent policies that looks after the banks and ultra rich whilst the governments inflame inflation with more war spending and debts and deficits into the trillions.

Yesterday’s news of the Japanese Yen collapse against the dollar and the first American bank this year in Republic First to be seized by the FDIC is clear evidence that chaos is about to begin and the system is fragile.

Its a dire situation that is now about to become far worse with a new wave of inflation and everything is at risk from housing, stocks, bonds, businesses, banks, governments, households, jobs and currencies.

To help and support this page continue pls donate below.

https://www.paypal.com/donate/?hosted_button_id=FK2MTVFAJ67QU